How to Minimize Risk and Maximize Return on Artwork Investments

- OGP

- Feb 15, 2021

- 6 min read

Updated: Oct 6, 2022

By OGP Reporters / Members Contribute File Photos

Oh Good Party

As with any investment, you need to do your research and go beyond your comfort zone. The art market is fickle, and there are no guarantees of profitability, but the key is when evaluating a work of art, our art appraisers look for: Authenticity, condition, rarity, provenance, and value...You have to keep track of price changes, if only for insurance purposes. Like it or not, collecting art is always a form of investment. Fortunately, it’s a very lucrative investment.

Collecting was typically a hobby, and a passion. Collectors bought what they liked that concentrated their portfolios on a single class, or they bought an artwork after considering its long-term value, and tried not to overpay.

But as art prices soared, the market changed. Art buyers are now much more likely to make potential profit part of their decision. When an art collection can make up a significant percentage of an individual's net worth, who wants to wait?

As a result, art as investment is increasingly accepted in both the artistic and financial worlds. Such as financial advisers focus on art as a source of long-term profit, or new hedge-fund (called art funds) that buy and sell artworks and share the profits.

Since 2000, the Price Index for the global Art Market as a whole has grown by 36% (by Artprice). In comparison, the S&P 500 has gained 86% over the same period, the FTSE 100 is up 2% and France's CAC 40 is down -19%. The Art Market taken as a whole, and including all periods and price ranges is therefore a competitive form of investment and an alternative to traditional financial assets.

“Increasing awareness of art as an asset class: 53% of wealth managers had a high level of awareness of developments linked to art as an asset class, up from 43% in 2012 and 33% in 2011; this signals that increasing attention is being paid by the wealth management community to the art and collectibles market.”By Deloitte and ArtTactic Art & Finance Report 2014.“

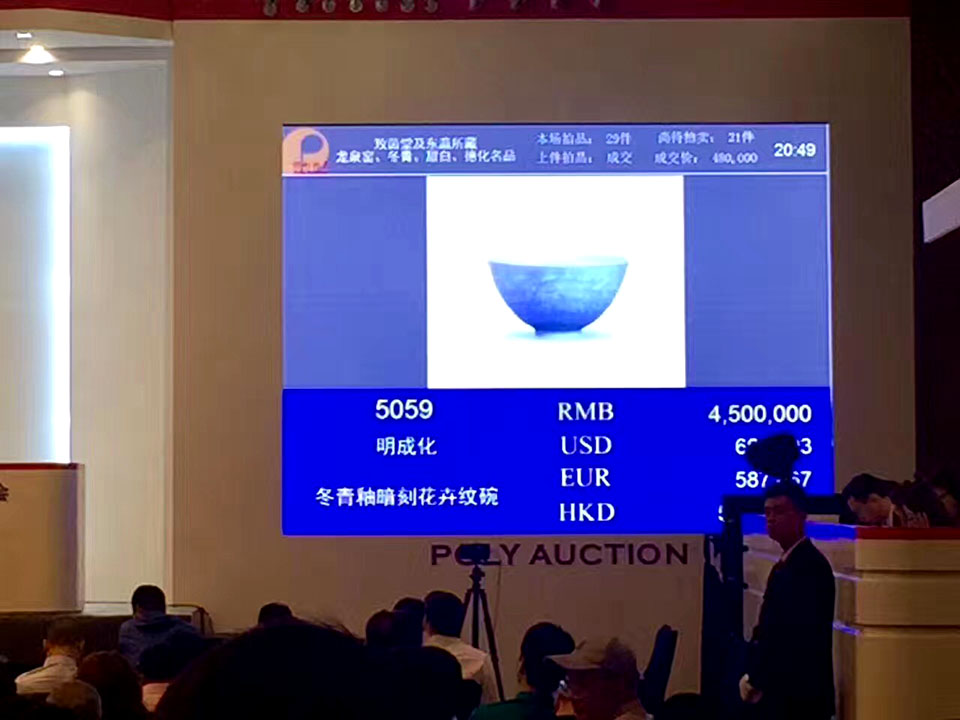

The art market has proven itself to be a great store of wealth. One would expect to earn dividends from equities, a share of the profits from startups, and rents from real estate. In fact, Liquidity in selling art is also substantially less than in equities and even real estate, and some auction houses commissions are quite high. Buyers pay commissions at auction houses ranging from 12.5% to 25%, depending on the sale price, and dealers' commissions are privately negotiated with the seller.

Research we completed recently and presented in August 2013 at the Global Finance Association conference shows investors would be wise to be wary. The returns of some art class have been significantly overestimated, and the risk, underestimated. With art assets, the ability to determine the legitimacy and the price, comes with expertise - this barrier makes it difficult for the traditional investor to confidently invest.

A smart and tasteful collector of art who enjoys art but also buys with an eye to reselling it to make a good return, but artworks are primarily aesthetic investments, not financial ones.

So we have to closely monitor the volatility of artists' prices and bear in mind the specificities of the Art Market: factors like the market liquidity of works, transaction fees, insurance costs, etc.

The transaction costs in art are, by and large, much higher than in stocks and real estate, but the opportunity to make gains in the short-term are also much higher. With real estate, in a year or two, you might be able to make 5% to 15% but, with art, you have the opportunity to make serious money that made 100% returns on many deals.

How to minimize risks and maximize returns in art investments?

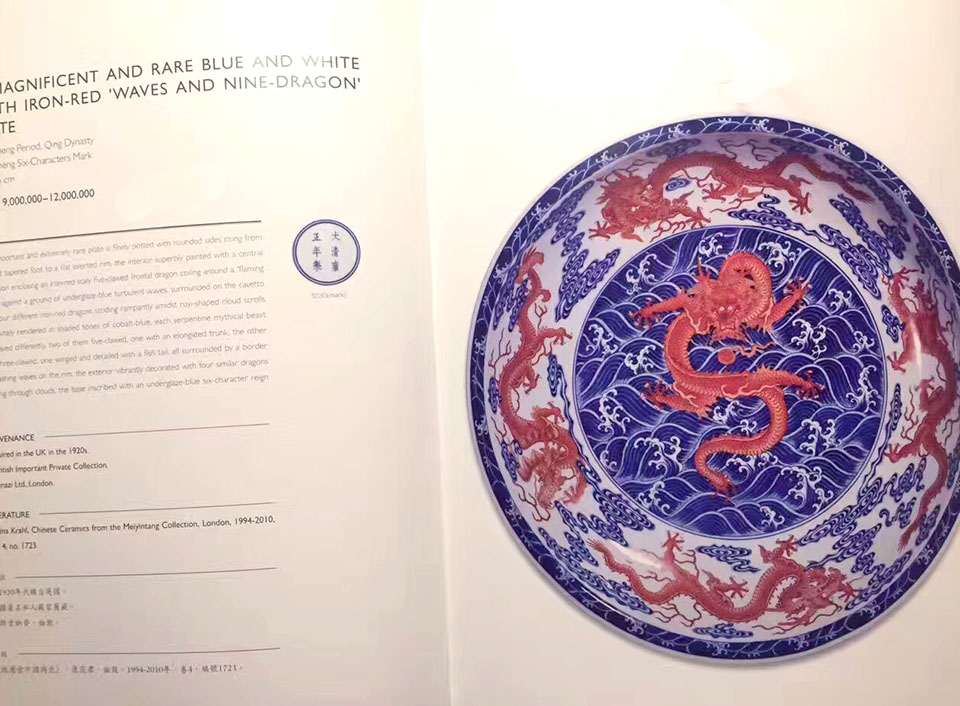

As with any investment, you need to do your research and go beyond your comfort zone. The art market is fickle, and there are no guarantees of profitability, but the key is when evaluating a work of art, our art appraisers look for: Authenticity, condition, rarity, provenance, and value.

E.g, the rarity of a work of art is what gives it value, so an original will always be worth more than a reproduction. While a giclée (giclée is a reproduction printed on fine paper or canvas with color and clarity that can rival the original.) may come labeled with superlatives like "museum quality" or "archival", and the seller may hawk a certificate of authenticity, it will never be as valuable as an original. Some artists and appraisers even view giclées as a gimmick for novice artists and neophyte collectors. But it's still a copy.

Still, there's no denying that a giclée puts fine art within reach for many art enthusiasts, and while a certificate doesn't lend much value to the reproduction, a fresh signature could bump up future value. Museums do, however, sell giclée versions of masterpieces to generate income. But several factors determine the value of an artist's print: the size of the edition, that is, the number of prints the artist makes of one work; the significance of the work; the condition of the print; and whether it is signed and numbered by the artist. In the market for prints, it is rarity that bestows value. A low run of limited edition prints is more valuable than a mass-produced image. Museums do, however, sell giclée versions of masterpieces to generate income. These giclées, though pleasing to your eye and soul, won't pull in any future income for you.

Some auctions work on the principle that buyers believe authenticity equals high value. Unfortunately, authenticity does not guarantee the rarity of a piece or its importance in the art world. The critical guideline for buying art cannot be repeated too often: art that is valuable is art that is rare.

Most collectors who buy artworks don't end up selling them later on, and that fact can skew pricing samples for art. When an artwork is auctioned, it's often because the owner of the work thinks the piece will attract a handsome price. Auction prices reflect only a tiny amount of collection resales, and our statistical results that only 5% of artworks bought are ever resold.

Still, art is a long-term investment, and while the art market can be stable or even show gigantic returns on an investment during boom times, it is one asset that can short-term plummet in value during seasons of recession. The artwork changes each day as lots are sold off, and written appraisals suggest pieces are offered at a fraction of their value.

By paying $680 for a small still-life by Helene FUNKE at Christie’s in London in 1995, a collector generated a spectacular return without having to raise a large initial sum. Twenty-two years later he sold the work in Vienna for over $38,000 (a percentage return of 5,510%).

Art assets are ideal for long-term investments.

And, there is no minimum investment.

Over the last 20 years, the art market has massively increased in liquidity and has grown to now be widely appreciated as a genuinely efficient market to which collectors has substantially contributed.

The financial attractiveness of art, and particularly of Contemporary art goes hand in hand with an inevitable financial risk. (The value of many works sold in 2017 has greatly diminished since their last appearance in the auction room. ) Some shorter holding times do not guarantee easy winnings, and, in any case, quick profits are not always the motive for resale. Liquidity requirements have long been recognised as a common motive for rapid resales, with certain collectors reselling works they have just acquired, even if it means incurring heavy losses in addition to transaction costs.

OGP use own regression analysis and mass of market information to determine collections to purchase for investment purposes. We organize artworks with similar core characteristics into logical groups according to their specific criteria, in accordance with USPAP (Uniform Standards of Professional Appraisal Practice) guidelines, which is also known as a IRS appraisal. The characteristics include artist, genre, date range, content, materials, size, coloration, style, and the collection record among others. Then, OGP targets works by artworks that have shown appreciation over the past 5 years and recommend to our private collectors and potential buyers. Many reports have noted upon the lack of transparency in the art market, but OGP provide a way for transparency to the benefit of every collectors and investors.

Anyway, visit auction house, museums, galleries, art institutions in your area regularly and OhGoodParty.com if you're considering a piece for your collection or investment, get an appraisal. Buying art is an emotional decision, but look for quality, and don't buy anything in bad condition if you are thinking of it as an investment.

Please consider these tips for choosing fine artworks and prove worthy investments.

You have to keep track of price changes, if only for insurance purposes. Like it or not, collecting art is always a form of investment. Fortunately, it’s a very lucrative investment.

Kommentare