China Continues to Exhibits its Global Art Ambition & Wealth - Artwork Financial Investment Analysis

- OGP

- Dec 15, 2017

- 7 min read

Updated: Oct 6, 2022

By OGP Reporters / Members Contribute File Photos

Oh Good Party

Anyway, the annual report is widely regarded as the most comprehensive summary of the art market available — Using data from dealers, auction houses, art and antique collectors, art and financial databases, and industry experts (including artnet), OGP tracks the growth of the global art market from year to year, analyzes regional performance, art buyers and world wealth, and examines the economic impact of the art trade on the global economy.

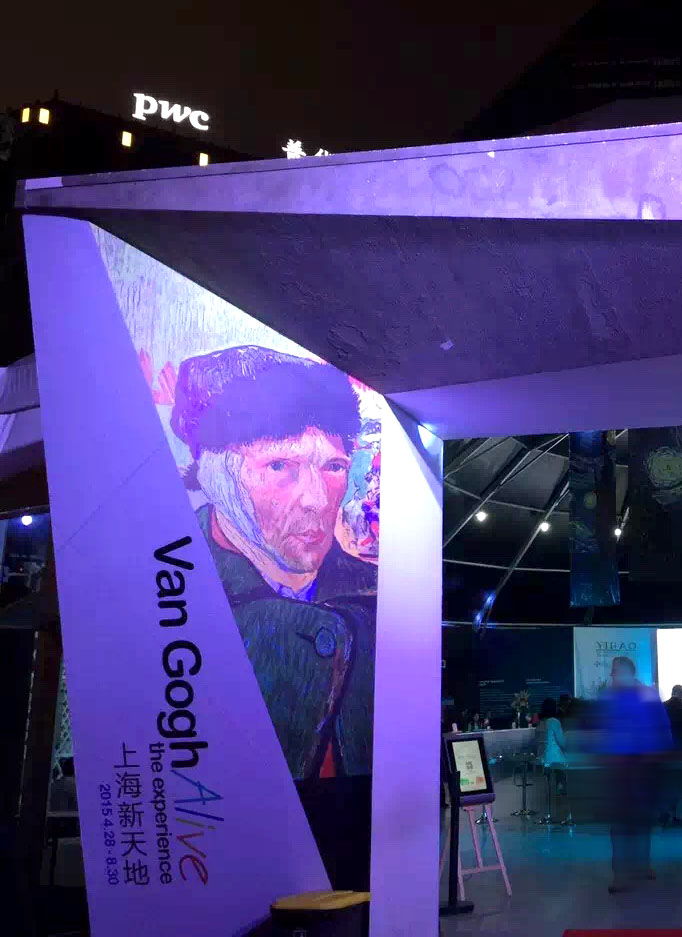

In the past few years, Chinese lost interest in the arts due to the emphasis on economic development. Today’s improved conditions, however, are shifting society’s focus toward spiritual living. Wealthy investors are warming up to the value of personal art collections.

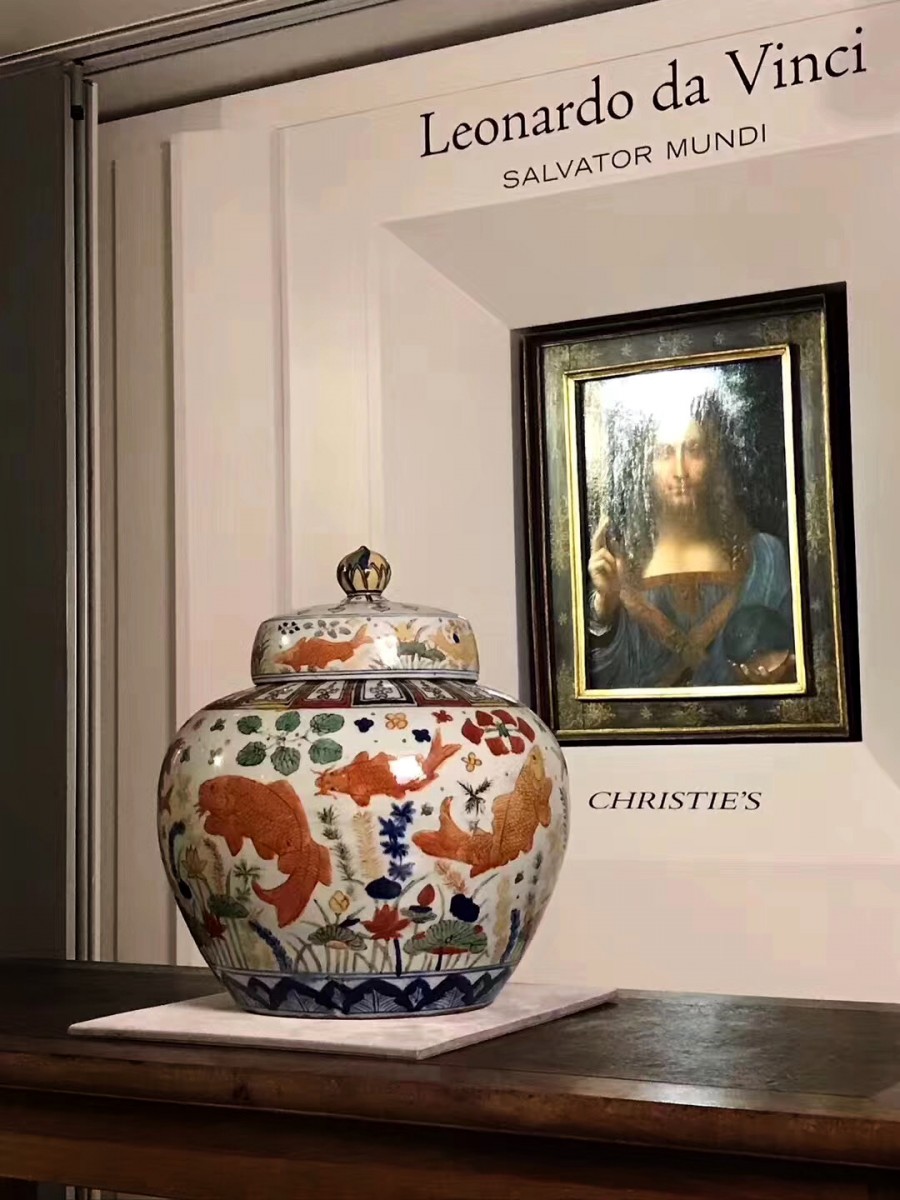

Each year, an increasing number of Chinese interact with the art world. China leads the Asian arts market and plays a major role on the international art scene. Foreign companies like Christie’s and Sotheby’s are making slow progress in China due to regulatory red tape, while several domestic auctions (Poly, Guardian and Council)companies show strong performance.

Our findings quantify what many market-watchers have long observed: As increasingly wealthy buyers compete for a shrinking supply of name-brand artists, the art market has become highly concentrated at the top.

In 2016, China returned to world leader position with $4.8 billion in turnover and 91,400 lots sold. The USA was second with $3.5 billion and 72,500 lots sold. The United Kingdom came third with 17% of the global auction turnover. Global auction turnover totalled $12.45 billion in 2016 with 675,500 lots sold. The last year’s best result was $81.5 million for French artist Claude Monet’s La Meule (1891), But the world’s top-selling artist in 2016 was Chinese artist Zhang Daqian ($355 million). Aisa arts (including antiques, paintings, etc.) total turnover increased 90% of the value of all arts auctions worldwide by Chinese buyers in 2017.

Global art auction turnover reached $6.9 billion in H1 2017. The recovery was mainly due to the performance of the US market, with turnover up 28%. With $2.2 billion, the USA overtook China’s $2 billion (Some reports from Artprice). In the USA, 38,000 Fine Art lots sold for a total of $2.2 billion over the six month period whereas, in China, 37,900 Fine Art lots sold, generating a total of $2 billion. Every year since the Chinese art market boom (circa. 2008 - 2013), one of the two superpowers has taken a significant lead over the other. But for H2 2017, the rivalry between the two superpowers will be interesting to follow since China usually generates a higher turnover in the second half of the year (confirmed over the past eight years) whereas the Western market usually posts a lower level of activity in H2.

The Art Market is an efficient, historical and global market whose ability to withstand economic and geopolitical crises is now beyond any doubt.

Anyway, the annual report is widely regarded as the most comprehensive summary of the art market available — Using data from dealers, auction houses, art and antique collectors, art and financial databases, and industry experts (including artnet), OGP tracks the growth of the global art market from year to year, analyzes regional performance, art buyers and world wealth, and examines the economic impact of the art trade on the global economy.

1. Mainland China is on the rise.

Mainland China sold more Chinese art and antiques in 2016 by value than any other country in the world. Total sales in mainland China grew by seven percent, reaching $ 4.8 billion (¥ 33.4 billion), while the Western art market experienced a contraction. In the US alone, the market declined by 26 percent, while the United Kingdom saw a 14 percent decline year-on-year.

2017 is likely to be a challenging year for many global economies, with low and uneven growth and continued economic and geopolitical uncertainty. These underlying factors affect consumer and investor sentiment, which in turn trickles down to the art market. Continued uncertainty or worries over the future stability of other asset markets could, on the one hand, enhance demand as investors and collectors increasingly view art and antiques as a relative safe haven amidst volatility elsewhere.

Arts gradually become an investment option. Beijing, Shanghai, Guangdong and Hong Kong are the three cities with the highest market demand. Besides, Chinese citizens are eager art patrons. There were 4692 museums in China in 2015 that 85.5% is free. The number of museum visitors reached 0.7 billion each year which hints at a growing population of potential art consumers. The National Museum of China Visitors to the 7.6 million visitors in 2016 that the most visited museums in the world in 2016.

2. One of the driving factors for the recovery of the market in mainland China is the growth on the top end of the market (which sold for more than ¥ 50 million) .

Mainland China is responsible for 29 percent of these many sold in 2016-more than double the percentage just two years ago. Even if the number of deals decreased in 2017, the sales value in fact increased. The number of arts in the high-end market grew by more than 200% because high-earning Chinese consumers are more willing to invest in and collect art as their incomes continue to soar. As a result, the average lot price in mainland China has continued to grow since 2013, reaching $ 18,967 (¥ 131,062) last year.

The global economy, and in advanced economies, levels of inequality are at their highest level in decades. The top 1% of the world’s wealth holders have continued to claim a larger share of wealth and incomes, owning more than half of the world’s assets in 2016. The concentration of wealth in the widening segment of global HNWIs has undoubtedly been beneficial for the art market in recent years, in particular boosting sales at the high end of the market, which have been instrumental in driving aggregate figures. Greater wealth in the top percentiles of the population has led to greater spending on art, and has been an important factor supporting strong sales and rising prices in polarized sectors such as Modern and Contemporary art. But it has also created a narrow market (by value) where much of the best performance has been concentrated in the top end, which is also susceptible to certain risks and limitations.

The analysis of both the dealer and auction sector also shows that these transactions at the high end make up only a tiny portion of the day-to-day activity of the market, with the sales priced at over $1 million accounting for less than 1% of auction, while the majority of transactions take place at levels below $50,000. Therefore while the high end is to some extent supported by the growing concentration of wealth and the lowest end (sales less than $5,000) have been boosted by the emergence of young global collectors and the growth in online sales, the middle market remains the most under pressure. Chinese consumers are divided into three types: for consumption, for collection, for investment. The consumers with monetary background account for 50% of the private collection market. For investment purpose, some organizations, like monetary funds, are starting to view arts as an promising destination for their money. And more than 20% of Chinese high income individuals are willing to spend more than 1% of their assets on arts collection.In emerging markets, increasing art sales have been driven by the spending power of the top 1%. However, there are limits to the extent of the development and depth of the art markets in these regions until more middle class and upper-middle class consumers engage and start to purchase art — because a greater share of art investment in the middle to top is the increasing.

3. The market for Chinese art and antiques is getting more concentrated toward Asia, as major auction houses shift their inventory to Hong Kong.

The share of Chinese art and antiques sold in North America and Europe dropped from 33 percent in 2011 to 21 percent in 2016. The art market is a good example of a ‘winner-takes-all’ market, where a very small proportion of artists is responsible for a very large market share, and a very large proportion has a very small market share. Similarly, Poly, Guardian, Xiling Yinshe, Hanhai, Council cover more than 60% market share in high end market.

There are several key changes in the distribution of global wealth that are likely to have a significant impact on the art market over the next decade. In 2017, the Asia-Pacific region exceeded North America in terms of the population of HNWIs, and HNW wealth in this region is growing at a significantly faster rate. Although the US is likely to remain a leading center of wealth going forward, the global distribution of HNWIs is likely to look very different in ten years, and the preferences of buyers in Asia and other regions will undoubtedly influence which sectors and centers of the art market dominate in future. These regional shifts in wealth will continue to influence the development of the art market in different regions, with growth of HNWIs undoubtedly supporting sales in the key art market hubs, as well as encouraging the development of new and local art scenes. But, we have to mention that non-payment and late payment remains a major problem in mainland China-and it's getting worse. Only 51 percent of buyers actually paid for the work that purchased them in 2016. We attribute some of this action to the rise quickly in high-end sales, which are often paid for in installments.

Overall, the art market is kept to grow constantly in 2017 with the development of Chinese economy. Arts have become more and more popular with an increasing number of arts museum visitors and students majoring in arts programs. For selling channels, digital arts market shows a strong potential with the wide application of mobile system. Our opinion the key factor supporting the dominance of the art market hubs of the China is that alongside wealth and infrastructure, these markets have been among the most transparent and regulated centers for the trade, where the legal and fiscal systems offer a level of protection to both buyers and sellers, while providing incentives to boost a healthy inflow and outflow of art.

Comments